It’s a new year and a new administration at the West Deerfield Township Assessor’s office. We would like to extend our thanks to Tom Healy for his 12 years as Township Assessor and both Joe and Mary for their years of service. While the staff is new, our commitment to serving the West Deerfield Township remains as strong as ever, and we’re excited about and poised to make changes that help our community and its residents.

Andrew Richter, MAI, CIAO is thrilled to be starting as Township Assessor. Andrew brings his 20 years of real estate appraisal experience to the assessor’s office in the hopes of improving the efficiency and effectiveness of the office. With experience both preparing appraisals for and ruling on assessment appeals as an alternate member of the Lake County Board of Review, Andrew has the knowledge and experience to value all types of real estate in the township fairly and expertly.

PRINCIPLES THE ASSESSOR’S OFFICE FOLLOWS. The Township assessors use the same principles, techniques and methodologies as those employed by fee appraisers with only slight variations to accommodate the uniformity criteria of the United States Constitution and the Illinois Constitution.

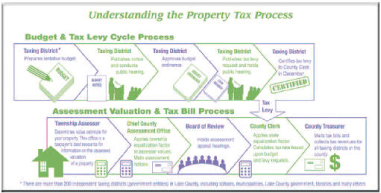

THE ULTIMATE PURPOSE OF ASSESSED VALUE IS TO APPORTION THE TAX BURDEN. The Assessor is not responsible for deciding the tax burden. That is established by the major taxing bodies. The role of the assessment is to provide a means to divide the tax burden in a fair and equitable manner based on the value of the real estate.

THREE APPROACHES TO VALUATION. The Assessor uses three traditional approaches to appraise property: the cost approach; the market or sales comparison approach; and the income approach. These are standard methodologies in the appraisal industry. Variations in the application of these approaches are necessary because the Assessor is also required to ensure that similar properties have similar assessments. This is known as assessment uniformity.

STATISTICAL TESTING AND ASSESSMENT ANALYSIS ARE INTEGRAL PARTS. As a result, assessors rely on statistical measures much more than fee appraisers. Armed with means, medians and coefficients of dispersion, the Assessor is able to confidently appraise properties at the appropriate percentage of market value and ensure the degree of uniformity in the Township is within acceptable parameters.

•Certified Illinois Assessing Officer

•Certified Illinois Assessing Officer•MAI designated Certified Commercial Appraiser

•Past Former member of the Lake County Board of Review

•20 years as an appraiser in Deerfield

•Lifelong Deerfield Resident

EXEMPTIONS THAT CAN REDUCE YOUR PROPERTY TAX BILL.

Contact our offices with questions, applications and required documentation to take advantage of all the exemptions that are available to you.

Hours: M-F 8:30am -4:30pm

Call: 847.945.3020

EXEMPTIONS: Below are some of the available exemptions. Beginning in 2020, all applications must be submitted on line and you must create a “Smartfile E-Filing Portal” account at this website: https://lakecountyilpaefile.tylertech.com/lake_il_sf

Senior Homestead Exemption Senior Deferral Disabled Persons’ Homestead Exemption Other Exemptions available are: – Disabled Veteran’s Exemption up to $100,000 of the equalized assessed value is lowered – Returning Veteran’s Exemptions This exemption lowers the equalized assessed value by $5,000 – Home Improvement a permit from the local municipality is required to receive this exemption Click here for a complete list and requirements to qualify: https://www.lakecountyil.gov/156/Tax-Relief

is a $8,000 reduction in the assessed value of your property, if that property is your primary residence on or before January 1 of that tax year.

is a $8,000 reduction in the assessed value of your property the tax year you turn 65 years of age on your primary residence.

This exemption freezes the assessment on your property if the total household income is $65,000 or less. This is an exemption that must be renewed each year.

is a state loan with a simple interest of 6%. Repayment of this loan is due upon death or sale of house. To qualify, one must be 65 years of age as of June 1st of the tax year, have a household income under $65,000, must have proof of insurance, property taxes must be current, and the property must be your primary residence. Call the Lake County Treasurer for more information at 847-377-2323.

is a $2,000 reduction of the assessed value of the primary residence.

Any other questions? You can email [email protected]